The company will abandon the pretense that its UK sales are consummated in Luxembourg and that the money floats in a state of taxless grace in the middle of the Irish Sea.

The move isn't entirely voluntary, of course. As of this April, companies that launder their profits offshore will still have to pay 25% tax on them in the UK. It remains to be seen whether Apple, Google, Facebook and other dodgers will follow suit.

A year ago, North claimed in an interview with the Guardian that Amazon's European corporate structure was not determined by tax avoidance strategies, insisting it would be impossible to route sales to UK customers through a British company paying tax to HMRC. "We just couldn't do that," he said. "And a single European business is going to need a single European headquarters."

Latest accounts for Amazon.co.uk Ltd show sales of just £449m for 2013 and a tax charge of £4.2m. Elsewhere in its corporate filings, however, Amazon attributed $7.29bn (£4.71bn) of worldwide net sales to the UK for the same year.

Amazon to begin paying corporation tax on UK retail sales [Simon Bowers/The Guardian]

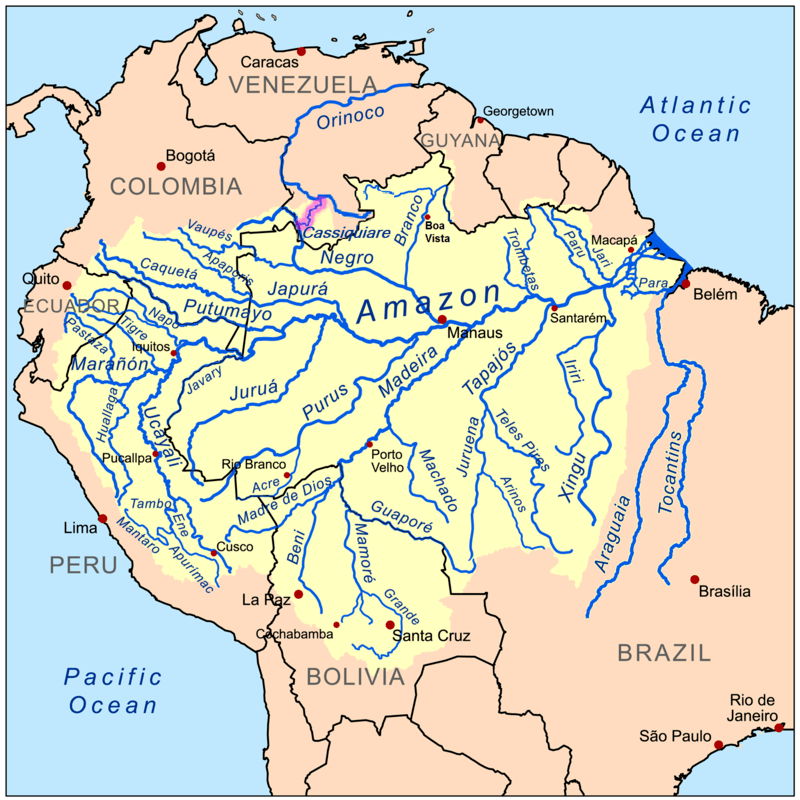

(Image: This is a map of the Amazon River drainage basin with the Casiquiare River highlighted., Kmusser, CC-BY-SA)